Procurement and Accounts Payable: Building a Unified Workflow for Cost Control and Compliance

Procurement and Accounts Payable: Building a Unified Workflow for Cost Control and Compliance

Learn how aligning procurement and AP helps reduce costs, improve compliance, and streamline your finance workflows.

Imagine trying to manage your household finances without knowing who’s buying what or when bills are due. That’s what it’s like when procurement and accounts payable (AP) teams work in silos. Purchases get made. Invoices pile up. And nobody’s quite sure if the budget’s still on track. In fast-moving companies, this disconnection leads to more than inefficiency - it opens the door to overspending, delayed payments, and compliance risks. The solution? A unified workflow that brings both functions onto the same page.

What this blog covers:

- What is the relationship between procurement and accounts payable?

- Why procurement and AP alignment is critical for finance operations

- Challenges caused by disconnected procurement and AP teams

- How automation bridges the gap between procurement and AP

- Benefits of unifying procurement and accounts payable processes

- How Spendflo helps align procurement with accounts payable

- Frequently asked questions on procurement and accounts payable

What Is the Relationship Between Procurement and Accounts Payable?

Procurement and accounts payable (AP) are two sides of the same coin. Procurement manages what an organization buys, while AP handles how and when payments are made. Together, they form the purchase-to-pay (P2P) cycle - where every purchase request eventually turns into a paid invoice, tracked and audited for compliance and accuracy.

Why Procurement and AP Alignment Is Critical for Finance Operations

When procurement and accounts payable operate in sync, finance teams get what they’ve always wanted: clarity, control, and confidence in every dollar spent. This alignment turns fragmented workflows into a single, streamlined engine that powers smarter decision-making across the board.

Here are the reasons why procurement and AP alignment is essential:

Enables End-To-End Spend Visibility

Procurement knows what’s being bought. AP knows what’s being paid. But when both functions are connected, finance leaders can see the full picture - from purchase request to final payment. This visibility helps track spend against budgets in real time and spot trends before they become problems.

Improves Budget Accuracy and Forecasting

Disconnected systems often lead to outdated or inaccurate financial data. With procurement and AP aligned, finance teams can rely on real-time data to forecast cash flow more precisely, close books faster, and make proactive decisions backed by current numbers.

Reduces Errors and Duplicates

Manual handoffs between procurement and AP are breeding grounds for mistakes - duplicate invoices, mismatched POs, or approvals that fall through the cracks. An integrated workflow reduces these risks by syncing records automatically and enforcing standardized processes.

Strengthens Internal Controls

Without alignment, it’s easy for purchases to fall outside policy - or worse, go completely untracked. When procurement and AP share systems and data, enforcing approval workflows, audit trails, and compliance protocols becomes second nature.

Challenges Caused by Disconnected Procurement and AP Teams

When procurement and accounts payable don’t speak the same language - or worse, don’t speak at all - cracks begin to form across the entire finance function. What seems like minor friction can snowball into operational, financial, and compliance issues.

Here are some of the most common (and costly) challenges caused by a lack of alignment:

Lack of Data Synchronization

Procurement systems track what was ordered. AP systems track what was paid. But if those systems aren’t integrated, matching purchase orders with invoices becomes a guessing game. This leads to delays in processing payments, difficulties in auditing, and missed opportunities for cost recovery.

Delayed Approvals and Payments

Disconnected workflows often mean approvals are routed manually - bouncing between emails, spreadsheets, and message threads. The result? Bottlenecks. Suppliers wait longer for payments, early payment discounts are missed, and finance teams are stuck chasing down approvers.

Limited Cost Accountability

When procurement acts without visibility into payment terms, or when AP pays invoices without validating against approved POs, accountability fades. It becomes hard to know who spent what, with which vendor, and whether the purchase was even necessary in the first place.

Compliance and Audit Risks

Auditors love clean paper trails. But siloed procurement and AP teams make it hard to prove compliance with internal policies or regulatory standards. Missing documentation, inconsistent data, and poor record-keeping all raise red flags during audits - and can lead to costly penalties or reputational damage. It also increases the risk of failing to meet regulatory requirements.

How Automation Bridges the Gap Between Procurement and AP

Bringing procurement and accounts payable together isn’t just about communication - it’s about connection. And automation is the glue that holds it all together. By replacing manual processes with smart, integrated systems, organizations can bridge the gap between teams, eliminate friction, and unlock a faster, more transparent purchase-to-pay cycle.

Here’s how automation makes that happen:

Centralized Data Flows

Instead of juggling disconnected spreadsheets, emails, and legacy systems, automation consolidates procurement and AP data into a single source of truth. Purchase requests, POs, invoices, approvals, and payment records - everything flows through one platform, ensuring consistency and accuracy at every step.

Real-Time Approval Workflows

With automation, approval chains don’t get lost in inboxes or delayed by vacation calendars. Invoice approval is rerouted instantly to the right stakeholders, with automatic reminders and escalation paths. This speeds up turnaround times and keeps critical procurement moving without manual intervention.

Automated Matching and Reconciliation

Three-way matching - comparing purchase orders, invoices, and goods receipts - is tedious when done manually. Automation handles it in seconds. If something doesn’t match, the invoice verification system flags it for review. This reduces human error, accelerates processing, and strengthens internal controls.

Simplified Vendor Management

From onboarding to payment, automation gives vendors a consistent, transparent experience. Supplier portals let them submit invoices, track p`ayment statuses, and update their information - all without relying on back-and-forth emails. This reduces admin time for AP teams and improves supplier relationships.

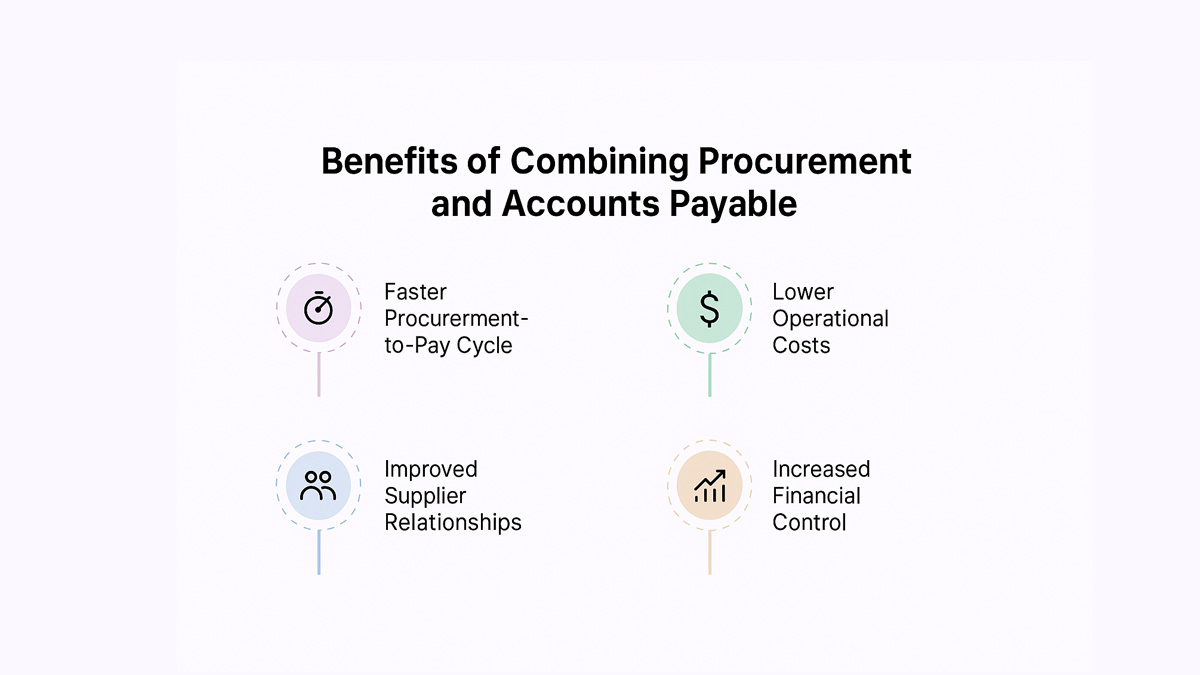

Benefits of Unifying Procurement and Accounts Payable Processes

When procurement and AP operate under one unified framework, the impact is felt across the entire organization. It’s not just about speed - it’s about smarter spending, tighter controls, and better relationships with vendors and stakeholders alike.

Here’s what happens when you bring these two functions together:

Faster Procurement-to-Pay Cycle

With integrated systems and procurement workflows, every stage - from requisition to vendor payment - moves seamlessly. No more chasing approvals, waiting for manual data entry, or fixing mismatched documents. The result? Shorter cycle times and more agility across teams. This also speeds up payment processing, improving vendor satisfaction.

Lower Operational Costs

Manual processes are expensive. They burn time, increase error rates, and slow down finance operations. A unified procurement process automates routine tasks, reduces rework, and frees up teams to focus on high-value activities - like strategic sourcing or spend analysis.

Improved Supplier Relationships

Improved vendor relationships build trust and open doors for better terms and early-payment discounts. Vendors want visibility and timely payments. When procurement and AP are aligned, they get both. Faster approvals, accurate POs, and on-time payments build trust - and make your company a preferred customer. This also opens doors for better terms and early-payment discounts.

Increased Financial Control

Unified workflows give finance teams end-to-end visibility - from budget planning through to payment reconciliation. This means fewer surprises, tighter compliance, and better forecasting. It also helps catch rogue spending early and enforce financial discipline across departments. It strengthens overall financial management by aligning spend with strategy.

How Spendflo Helps Align Procurement with Accounts Payable

Spendflo brings procurement and accounts payable onto the same page - literally. With a centralized platform that manages everything from vendor selection to invoice tracking, teams gain real-time visibility across the entire purchase-to-pay journey. This improves spend management and reduces waste. Automated workflows, three-way matching, and integrated approvals ensure that nothing slips through the cracks. Finance leaders can enforce compliance, prevent budget overruns, and protect financial health through streamlined decision-making - all while saving serious time and money.

Frequently Asked Questions on Procurement and Accounts Payable

What tools help connect procurement and accounts payable?

Platforms like Spendflo, Coupa, and SAP Ariba help bridge the gap by integrating procurement, invoicing, and payment processes into a single workflow. These tools provide real-time visibility, automate approvals, and reduce manual errors.

How does automation improve invoice processing accuracy?

Automation eliminates the need for manual data entry by matching invoices to POs and delivery receipts. It flags discrepancies instantly, ensuring only valid and accurate invoices move forward for payment - saving time and reducing risk.

Why do procurement and AP teams often operate in silos?

It usually comes down to legacy systems and differing priorities. Procurement focuses on sourcing and vendor management, while AP is concerned with payments and compliance. Without a shared system or workflow, coordination becomes reactive and fragmented.

What are common KPIs to track in a unified procurement-AP process?

Useful metrics include purchase order cycle time, invoice processing time, percentage of invoices matched automatically, early payment discount capture rate, and exception rate. These KPIs help measure efficiency, accuracy, and cost-effectiveness across the process. Tracking invoice exceptions is also key to identifying bottlenecks early.

.png)

.png)