Procurement Purchasing Process : Improvements & Best Practices In 2026

Procurement Purchasing Process : Improvements & Best Practices In 2026

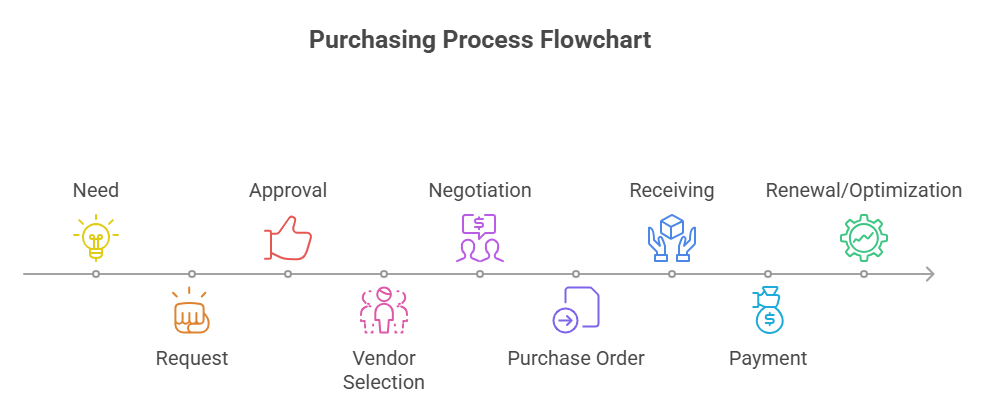

The purchasing process is the series of well-thought-out steps taken by companies to acquire new products or services.

“Procurement leaders say inefficiencies in purchasing cost businesses millions each year.” In fact, research shows that nearly 30% of companies take up to two months to complete a SaaS procurement cycle.

This makes the purchasing process more than a routine checklist; it's a critical function that directly impacts costs, compliance, and overall business performance. Understanding how purchasing works, and how it differs from broader procurement, is essential for organizations looking to save time and money.

What is Purchasing Process Optimization?

Purchasing Process Optimization is the structured set of steps a business follows to improve its process of acquiring goods or services. It includes everything from identifying a need and requesting approvals to selecting vendors, negotiating terms, and making payments.

While it may look straightforward, each stage involves careful checks to ensure compliance, control costs, and support organizational goals.

Today, many companies are turning to AI-powered solutions to optimize these purchasing cycle stages. By automating manual tasks, improving visibility, and reducing errors, AI helps procurement teams move faster and make smarter decisions transforming purchasing from a time-consuming process into a strategic advantage.

Purchasing Process vs Procurement Process Optimization

Many companies use “purchasing” and “procurement” interchangeably, but they are not the same. Understanding the difference helps you design the right workflows, reduce costs, and improve compliance.

Key Difference: Procurement vs. Purchasing

When to Use Procurement vs. Purchasing

- Procurement is ideal when you have to exercise strategic vendor relationships, negotiate price and spend optimization throughout the business. Example: screening SaaS vendors for long-term contracts.

- Purchasing is best applied to recurring, low-value, or one-time purchases where speed matters more than negotiation. Example: the ordering of laptops or office supplies.

Procure-to-Pay (P2P) vs. Order-to-Cash (O2C) Optimization

These two processes are often confused, but they address opposite sides of a transaction. Procure-to-Pay (P2P) covers the purchasing optimization process from the moment a need is identified to the final payment to a supplier.

Order-to-Cash (O2C), on the other hand, focuses on the seller’s side from receiving a customer order through to collecting payment.

We’re addressing this distinction here because P2P sits at the core of the purchasing process. Understanding how it differs from O2C prevents teams from mixing buyer and seller workflows, ensuring that procurement stays focused on controlling spend, improving compliance, and strengthening vendor relationships.

Strategic vs. Non-Strategic Purchasing Optimization

Not every purchase carries the same weight in terms of cost, risk, or long-term impact. Distinguishing between strategic and non-strategic purchases helps organizations allocate resources wisely and optimize the purchasing process.

Importance of a Purchasing Process Optimization

Purchasing is an ongoing activity in organizations. As business grows, the need for different products, tools, or software also increases. Therefore, it’s essential that companies set an optimized purchasing process.

Here are a few benefits of having an optimized purchasing process:

1. Reduced procurement risk

Deciding to purchase a new tool is a risk. Companies can be exposed to financial risks or reputational risks.

For example, a marketing team starts using a new SaaS email automation tool. After a few months, they realize their privacy has been breached, and customers’ personal data has leaked online.

This security risk tarnishes their reputation in the market, and customers will have a tough time trusting them again.

The best way companies can mitigate this risk is by including a no-compromise, vendor security analysis step in their purchasing process.

Assisted buying is another way out of this. This involves working with a set of procurement experts with immense knowledge and experience. They help with due diligence of the vendor and keep the entire workflow secure.

Related Read: From risk to resilience: Mitigating procurement risk challenges

2. Greater spend visibility

40% of organizations spend more than a million dollars on SaaS tools. However, without a documented purchasing process, there is a lack of visibility on spending. Therefore, it is challenging to calculate the ROI.

Setting up a purchasing process solves both challenges. Every team member follows a centralized purchasing process using a single procurement management platform, which means it’s easier to track spending, especially SaaS spending. Consequently, the company gets more clarity and visibility to calculate the ROI.

Related Read: SaaS-Visibility - A Complete Guide

3. Improved compliance with buying policies

Buying policy is a set of guidelines that regulates the purchasing process. It contains standards employees follow while purchasing a good or service.

For example, the buying policy mentions an approval workflow for getting the necessary permission from the designated authorities.

Making buying policy part of the purchasing process improves the chances of employees adhering to the standards. This also means the buying policy and purchasing process work as a team and not in isolation.

4. Fewer overlapping software licenses

Often, two different teams buy licenses for the same software independently due to a lack of communication and absence of a centralized process. By setting up a purchasing process, companies can maintain a record of software the teams already have.

Types of Purchasing Processes

Purchasing isn’t one-size-fits-all. The way your company buys goods or services often depends on the urgency, the type of item, and your overall business goals. Here are the most common types of purchasing processes and when to use them.

A) Strategic vs. Routine Purchasing

- Strategic purchasing: Long-term and planned. It usually involves large contracts, vendor negotiations, and ongoing relationships. Think of software platforms, long-term IT services, or annual SaaS renewals. Strategic purchasing impacts budgets, efficiency, and vendor partnerships.

- Routine purchasing: Day-to-day, lower-value buys. Office supplies, team subscriptions, or one-off purchases fall here. Routine purchases may not need deep negotiations but can still add up if left unmanaged.

Why it matters: Without proper systems, routine purchases can spiral into shadow IT, while strategic ones need careful vendor management.

B) Direct vs. Indirect Purchasing

- Direct purchasing: Buying items directly tied to your core product or service. For a SaaS company, this could be servers or critical software infrastructure.

- Indirect purchasing: Supporting items or services that aren’t part of the final product but keep the business running, such as HR software, marketing tools, or office equipment.

Why it matters: Both direct and indirect spend can drain budgets if not tracked. Spendflo centralizes visibility so you don’t lose control over either.

C) Centralized vs. Decentralized Purchasing

- Centralized purchasing: All buying decisions go through a single department, usually procurement or finance. It ensures consistency, better negotiation power, and stronger compliance.

- Decentralized purchasing: Individual departments or teams make their own purchase decisions. This can speed things up but often leads to fragmented vendor relationships and overspending.

Why it matters: A balance often works best. Centralized systems bring control, while decentralized processes keep teams agile.

D) Emergency Purchasing

Sometimes, businesses can’t wait for lengthy approvals like when a server goes down or a compliance tool expires unexpectedly. Emergency purchasing is about speed, often with fewer checks and negotiations.

Why it matters: While necessary, emergency buys are costly. With Spendflo’s renewal tracking and vendor intelligence, you can reduce last-minute surprises.

E) Sustainable / Green Purchasing

This focuses on buying goods and services that meet environmental and social responsibility standards like eco-friendly office supplies or vendors with strong sustainability policies.

Why it matters: Many companies now align procurement with ESG (Environmental, Social, and Governance) goals. Sustainable purchasing supports compliance, brand reputation, and long-term impact.

Optimizing Your Purchasing Process to Boost Your Deals

A strong purchasing process ensures cost savings, compliance, and smoother vendor relationships. Below are the 9 key steps to optimize your purchasing process:

1. Identification of the Needs / Define the Need.

The first step is to identify exactly what your business needs: SaaS, equipment, or services. An identified need prevents spending on things that are not necessary and budget conformity.

2. Purchasing Requisition Preparation.

When a need is realized, the employees place a purchase requisition. To automate this process using guided intake forms will help eliminate human error, and requests will reach the appropriate stakeholders in a timely manner.

3. Purchase Order Approval and Review.

The problem with approvals is that they Slow down procurement when it is not handled effectively. Automated processes can be used to direct the purchase orders to the appropriate decision-makers, reducing decision making time by 40 percent.

4. Request for Proposals (RFP) / Request for Quotation (RFQ).

In case of purchase that is large, organizations request the vendors to write a proposal or quotation. A centralized procurement tool is useful in comparing the options against each other to save time and provide transparency.

5. Contract Negotiation and Finalization.

Discussions on contracts are usually dragged out. With vendor intelligence software such as Spendflo, you can access benchmark data to negotiate smarter deals and finalize them faster to use when negotiating a deal and getting it finalized: customers have saved up to 30 percent at this point.

6. Vendor Evaluation and Selections.

Due diligence is important in evaluating vendors. With a vendor database that includes their performance history, you can ensure that you select good partners and will minimize risks based on quality or compliance.

7. Three-Way Matching

Finance teams match the purchase order, invoice, and receiving report before payment.This is an area to automate the check which eliminates errors and fraud while reducing disputes with vendors.

8. Invoice Approval and Payments.

Workflow invoice approval automation ensures timely payments to the vendors and full compliance with the payment process. Supplier relationships are also enhanced.

9. Performance Review and Accounting Records Update.

Lastly, accounting systems are to record all transactions and then do periodic performance reviews. These reviews enhance the relationship with vendors, emphasize the areas of savings, and make sure that the process is constantly being optimized.

Challenges in Procurement Optimization Process

The challenges in procurement largely depend on the business, but here are the most common Procurement teams face a wide range of obstacles that impact cost, compliance, and efficiency. Below are some of the most common challenges and how to solve them:

1. Risk Management and Mitigation.

Problem: Firms have a problem in finding stable suppliers hence poor quality deliverables and contract breach.

Solution: Develop a list of vetted vendors and deploy procurement software that has vendor intelligence. This will enable you to review vendors prior to onboarding and minimize the risk exposure.

2. Lack of Visibility

Problem: The procurement units that lack centralized data on vendors are less visible and therefore cannot manage costs or bring improved deals.

Resolution: Implement a procurement solution whereby you unify the spend and vendor data. Live dashboards can provide you with the visibility of the flow of money and where you can save money.

3. Manual Processes are prone to human error.

Problem: Spreadsheets and manual entry increase the risk of errors such as missed renewals, duplicate payments, or compliance issues.

Solution: The automation of intake, approvals and purchase orders will do away with human error, hence accuracy and compliance.

4. Approval Workflow Delays

Problem: Multi-level approvals tend to slow down the process of purchase and slows down the whole procedure of procurement.

Remedy: Automated approval processes and rule-based processes. This forwards requests to the appropriate stakeholders at a high speed, accelerating the decisions and minimizing bottlenecks.

5. Isolated Teams and Ineffective Cooperation.

Problem: The procurement, finance, and IT departments tend to operate in silos and thus there is a friction and slow decision-making.

Resolution: Procurement tools are centralized to form a single source of truth. The cross-functional teams are kept in check with the use of shared dashboards and automated notifications.

6. Limited Process Visibility

Challenge: In the absence of a clear view of every purchase step, managers do not have a way to monitor the progress or locate the bottlenecks.

Solution: Stage-by-stage tracking of workflow engines is a perfect visibility of the workflow that allows managers to intervene at early stages in case of delays or risk.

7. Communication Breakdowns

Issue: This is a problem where stakeholders and vendors have a misunderstanding that results in failure to meet deadlines or inappropriate requirements.

Solution: The use of collaborative procurement systems with in-app messaging and notifications along with vendor portals can make everybody updated in real time.

8. Gathering Right Data and Insights.

Problem: Procurement data is inconsistent or old and this makes it problematic to predict needs or prevent extravagance.

Solution: adopt cloud-based intelligence solutions that automatically record spend, consumption, and vendor information. Good data translates to superior decision making and no wastage.

9. Digital Technology implementation.

Problem: The use of spreadsheets that are prone to errors and cannot be scaled continues to be used by many teams.

Solution: Invest in digital procurement solutions, which automate the processes, minimize risks and enable the business to adjust fast to the market changes.

10. Stakeholder Alignment

Issue: Procurement leaders are not usually included in the strategic discussions, and this results in goal misalignment.

Solution: Incorporate heads of procurement in planning. Their contribution assists in regulating the prices of purchases and streamlining the effective processes.

11. Ensuring Compliance

Obstacle: Purchases may not be properly gone through company policies or place the firm at risk of litigation unless spending is well checked.

Solution: To make sure that internal policies and external regulations are adhered to at each stage automated compliance controls and audit trails should be used.

12. Contract Management

Problem: Poor contract management will result in conflicts, unfulfilled commitments and legal liability.

Solution: Digital repository of contracts that remind and alert teams to their obligations can be used to manage this and ensure renewals and remain legally insured.

13. Choosing the Right Vendors

Problem: Hasty vendor selection usually leads to bad partnerships.

Resolution: Unify due diligence and background checks, reference checks and collective vendor information portals among the team.

Key Steps in the Purchasing Optimization Process

A well-structured purchasing process ensures that organizations spend wisely, maintain compliance, and avoid costly delays. While every company has its own way of managing procurement, most follow a similar set of purchasing process steps.

Here’s a breakdown of the typical purchasing cycle stages and how they connect in practice.

1. Identify the Need

- What happens: A department or individual recognizes the need for a product or service.

- Example: The marketing team requires a new analytics tool to measure campaign performance.

2. Request & Approvals

- What happens: The need is formally submitted through an internal system or document for review.

- Example: The request is forwarded to procurement and finance for budget approval.

3. Vendor Evaluation

- What happens: Procurement researches potential suppliers, compares pricing, and checks compliance.

- Example: Three vendors are shortlisted, each offering different features and price points.

4. Negotiation & Contracting

- What happens: Terms and conditions are reviewed, and final agreements are signed.

- Example: The company negotiates a one-year contract with better payment terms.

5. Purchase Order (PO) Creation

- What happens: A PO is issued to confirm the purchase with the selected vendor.

- Example: Finance generates a PO that outlines the agreed price and delivery terms.

6. Receiving & Verification

- What happens: The goods or services are delivered and inspected for accuracy.

- Example: IT validates that all requested software licenses are active and functional.

7. Payment & Record Keeping

- What happens: The invoice is processed, and payment is made. Records are updated for compliance and audits.

- Example: Finance closes the transaction and logs it into the company’s accounting system.

8. Renewal & Optimization

- What happens: Contracts or subscriptions come up for renewal and are reevaluated.

- Example: A software contract is reviewed to determine if the same vendor should be renewed, renegotiated, or replaced.

Best Practices for Purchasing Process Optimization

1. Strategy for Automation Implementation

Manual operations such as data input, purchase requests, and invoice approvals are susceptible to error. Automation of these workflows reduces cycle time, eliminates delays in the approval process, and liberates teams to make strategic decisions.

The companies that automate claim to save 4+ hours per week per user of finance.

Example: Instead of chasing email approvals for every new laptop purchase, a company uses automated workflows to route requests directly to managers and finance. This ensures faster turnaround and fewer errors.

2. Three-Way Matching Protocols

One of the main ways of deterring fraud and multiple payments is three-way matching i.e., comparing purchase orders, invoices, and receiving reports. This process should be automated in order to make sure it is accurate and minimize conflicts with vendors.

Example: When ordering office chairs, the procurement team checks that the PO lists 20 chairs, the vendor invoice also bills for 20, and the receiving team confirms 20 were delivered before payment is approved.

3. Vendor Collaboration Improvement

Procurement is better done when vendors are not only considered suppliers but also partners. Transparency can be enhanced and long-term trust can be established through the usage of centralized platforms, performance monitoring, and effective communication channels.

Example: A company sourcing SaaS tools sets up a shared vendor dashboard showing usage and renewal timelines. This helps both the business and vendor plan upgrades and renewals collaboratively.

4. Total Cost of Ownership (TCO) Focus

It is shortsighted to look only at purchase price. Best-in-class teams determine the total cost of ownership including maintenance, upgrades, and vendor support. This assists in uncovering hidden costs and making wiser, long-term decisions.

Example: Instead of choosing the cheapest printer, procurement compares ongoing costs such as ink, paper, and servicing. The slightly higher-priced option turns out to be cheaper over three years.

5. Social Responsibility Integration

Modern procurement is not just about cost. Sustainability, diversity, and ethical sourcing have become more important to buyers. Making social responsibility part of purchasing decisions enhances brand image and aligns with corporate ESG objectives.

Example: When buying uniforms, a company selects a supplier that uses eco-friendly fabrics and fair labor practices, even if the upfront cost is marginally higher.

6. Standardization Procedures

Inconsistent buying practices cause confusion and risk. Setting universal policies to govern requisitions, approvals, and vendor appraisals guarantees adherence, reduces errors, and supports smooth scaling of operations.

Example: A global company introduces one standardized workflow for all software purchases across regions. This prevents duplicate buys, improves compliance, and speeds up audits.

6 KPIs and Performance Measurement Of Purchasing Process Optimization

Monitoring the appropriate measure allows the procurement teams to identify bottlenecks, enhance effectiveness, and prove ROI. The following are the most significant KPIs to be measured:

1. Procurement Cycle Time Measures.

Cycle time is the duration required to take between requisition to purchase order approval. Shorter cycle time implies a faster fulfillment and less operational delays. Workflows can cause a reduction in cycle times of 30-40%.

2. Cost Savings Measurements

Savings in costs are more than the negotiated discounts. Track evaded expenditures, decreased licensing prices and consolidations. According to Spendflo customers, optimized contracts and renewals can save up to 30% in software and spend on vendors.

3. Vendor performance indicators

Assess suppliers based on quality, delivery time, compliance and service level. An obvious vendor scorecard enhances accountability and amplifies supplier relationships.

4. Approval Time Tracking

Determine the time required at every step of approval. There are long delays which are usually an indicator of manual bottlenecks. The process of routing rule automation would enable teams to save on time per request thus enhancing its productivity.

5. Process Efficiency Ratios

The efficiency of operations can be emphasized by such ratios as the number of requisitions approved per employee or invoices processed per FTE. They also demonstrate that automation enhances throughput with no need to increase headcount.

6. ROI Calculation Methods

The combination of hard savings (cost reduction), as well as soft savings (time savings, compliance savings, reduction of vendor risk) is the true ROI. The average ROI is 2-3x in the first year of use by the companies using Spendflo.

Compliance and Risk in Purchasing Process Optimization

Compliance and risk management are essential elements of an effective purchasing optimization. They ensure that every transaction not only meets organizational needs but also aligns with legal standards, financial regulations, and quality expectations. By embedding these considerations into procurement, companies reduce exposure to fraud, penalties, and operational disruptions.

A) Regulatory Compliance

1. SOX Compliance Requirements

For publicly listed companies, the Sarbanes-Oxley Act (SOX) sets strict standards for financial reporting and accountability. Within purchasing, this means maintaining accurate records of approvals, purchase orders, and payments.

Internal controls must demonstrate that spending decisions are authorized, documented, and transparent, supporting both financial accuracy and investor confidence.

2. Industry-Specific Regulations

Procurement teams must also comply with industry regulations that vary depending on the sector. These can include healthcare data privacy rules, financial sector governance standards, or product safety requirements in manufacturing.

Each purchase must be evaluated against applicable regulatory frameworks to ensure that suppliers, contracts, and workflows do not introduce compliance risks.

3. Audit Trail Requirements

A complete and transparent audit trail is non-negotiable in modern procurement. Every step of the purchasing process from requisition to payment should be recorded and easily retrievable.

Detailed audit trails provide visibility for internal reviews and external audits, ensuring that purchasing decisions can be traced, verified, and justified at any point in time.

B) Risk Management Specifics

1. Supplier Risk Assessment

Organizations must systematically evaluate suppliers before and during engagement. This involves assessing reliability, compliance history, operational capacity, and overall reputation.

Ongoing monitoring ensures that suppliers continue to meet performance expectations and do not expose the company to avoidable risks.

2. Financial Risk Evaluation

Financial stability is another cornerstone of procurement risk management. Vendors must be assessed for their ability to fulfill contractual obligations without disruption. This includes reviewing their creditworthiness, payment histories, and long-term sustainability.

A strong financial evaluation framework prevents reliance on partners who may be unable to deliver over the contract lifecycle.

3. Quality Assurance Measures

Beyond compliance and financial checks, procurement must also enforce quality controls. Goods and services should meet agreed specifications, performance standards, and safety requirements.

Quality assurance protects against operational inefficiencies, reduces disputes, and upholds organizational standards across all purchasing activities.

Streamline Purchasing with Spendflo

Lengthy purchasing cycles drain budgets, delay operations, and frustrate teams. Without a structured system, approvals get stuck in inboxes, renewals slip through the cracks, and unnecessary costs pile up.

That’s where Spendflo changes the story. Customers consistently report up to 30% savings on software and vendor spend and 2–3× ROI in the first year. For instance, one finance team cut procurement cycle times by 40% and saved over $500K annually by consolidating vendors and automating renewals with Spendflo.

The risk of doing nothing is clear: wasted spend, compliance headaches, and missed opportunities to scale efficiently. By centralizing vendor management, purchase orders, and expense tracking, Spendflo gives finance and procurement leaders back both control and time.

Don’t let inefficiencies keep draining your budget. Book your free savings analysis with Spendflo today.

Frequently Asked Questions

How long does the purchasing process typically take?

Depending on the complexity of the vendors and approval processes, negotiations on the contracts, the purchasing process may require a few days to a few weeks. Automation also enables you to reduce the manual back and forth and final purchases in a matter of days.

Can small businesses benefit from purchasing process automation?

Yes. Small companies usually have limited resources and therefore, automation of the buying process saves on time and enables fewer errors. It also enables teams to have a better visibility in terms of spend without the necessity of having a large procurement department.

How do you prevent maverick purchasing?

You stop maverick spending by establishing the approval processes, vendor data centralization and policies. Compliance is also facilitated through automation tools which direct all purchases through the appropriate channels prior to spending money.

How do you ensure purchasing process compliance?

Policy plus technology are two elements that result in compliance. Instant purchase systems provide audit trail record, approval rule enforcement, and exception notifications in real-time, so you will be able to remain in compliance with both internal and external regulations.

.png)

.png)