What Is Invoice Processing in Accounts Payable?

What Is Invoice Processing in Accounts Payable?

Learn what invoice processing in accounts payable means, key steps, and how automation improves speed, accuracy, compliance, and control.

You know that moment when a vendor pings your finance team asking, “Hey, has my invoice been paid yet?” - and everyone scrambles through inboxes and spreadsheets to find the answer? That’s the everyday chaos of poor invoice processing.

In the world of accounts payable (AP), every invoice that enters your system plays a small but significant role in how smoothly your business runs. Get it wrong, and you’re looking at late payments, annoyed vendors, and some awkward conversations during audits. But get it right? You’ll unlock operational efficiency, financial clarity, and stronger vendor relationships.

This blog explores what invoice processing in accounts payable really means, why it matters, and how to do it better - especially with automation.

What this blog covers:

- What is invoice processing in accounts payable

- Why invoice processing is critical to AP success

- Steps involved in invoice processing for accounts payable

- Manual vs automated invoice processing: What’s the difference?

- Benefits of automating invoice processing in AP

- How Spendflo simplifies invoice processing in accounts payable

- Frequently asked questions on invoice processing in accounts payable

What Is Invoice Processing in Accounts Payable?

Invoice processing in accounts payable is the end-to-end workflow that businesses follow to receive, validate, approve, and pay supplier invoices. It ensures every invoice is logged, matched, and recorded properly before payments are released - maintaining financial control and compliance.

Why Invoice Processing Is Critical to AP Success

It might seem like a small task - just paying bills on time - but invoice processing is at the heart of every accounts payable team. When it’s efficient, the whole operation runs smoother. When it’s clunky? Delays, errors, and financial blind spots pile up fast. Here’s why nailing it matters more than most people realize:

Ensures Timely Payments and Avoids Penalties

Missed due dates can lead to late fees, strained vendor relationships, and damaged credit terms. A reliable invoice processing system keeps deadlines front and center, helping AP teams prioritize what needs to be paid and when - no guesswork, no scrambling.

Strengthens Vendor Relationships and Trust

Paying vendors accurately and on time builds trust. It also puts your company in a better position to negotiate discounts, favorable terms, or priority service. Vendors want to work with buyers who are easy to deal with - smooth AP workflows help you become exactly that.

Improves Financial Visibility and Control

With clear invoice records, AP teams can track how money flows through the business. This visibility makes it easier to forecast cash outflows, plan budgets, and respond quickly to any discrepancies - no more reactive firefighting.

Supports Audit Readiness and Compliance

Clean, well-documented invoice trails make audits painless. Whether it’s internal reviews or compliance checks, organized records mean fewer surprises and better control over risks like fraud or overpayments.

Steps Involved in Invoice Processing for Accounts Payable

Think of invoice processing like a well-choreographed relay race - each handoff matters. From the moment an invoice hits your system to the final payment confirmation, every step needs to work in sync. Here's how the process typically flows inside modern AP teams:

Invoice Reception and Logging

It all starts with receiving the invoice - whether it lands via email, EDI, a shared drive, or still (somehow) in paper form. The first job is to log it into your system, capturing key details like invoice number, date, vendor name, and payment amount. This is the first line of visibility - miss it, and you’re running blind.

Invoice Validation and Approval Workflows

Once logged, the invoice needs to be validated. Are the vendor details correct? Has the product or service been delivered? Are the prices and quantities in line with expectations? This stage often involves a formal approval workflow, where department heads or project owners give the green light before payment moves forward.

Invoice Matching and Documentation

Next comes invoice matching - a crucial control step. AP teams perform a two-way or three-way match: comparing the invoice against the purchase order (PO) and, if relevant, the delivery receipt. This ensures you only pay for what was ordered and received. Supporting documents are attached for audit readiness and future reference.

Payment Processing and Record Maintenance

After approvals and matches are complete, the invoice is cleared for payment. Depending on terms, payments may be immediate or scheduled closer to due dates. Once paid, the system records the transaction - updating ledgers, marking the invoice as closed, and ensuring your financial reporting stays clean and up to date.

Manual vs Automated Invoice Processing: What’s the Difference?

Manual invoice handling may “work,” but it’s slow, error-prone, and hard to scale.

Here’s how automation transforms the process from clunky to streamlined:

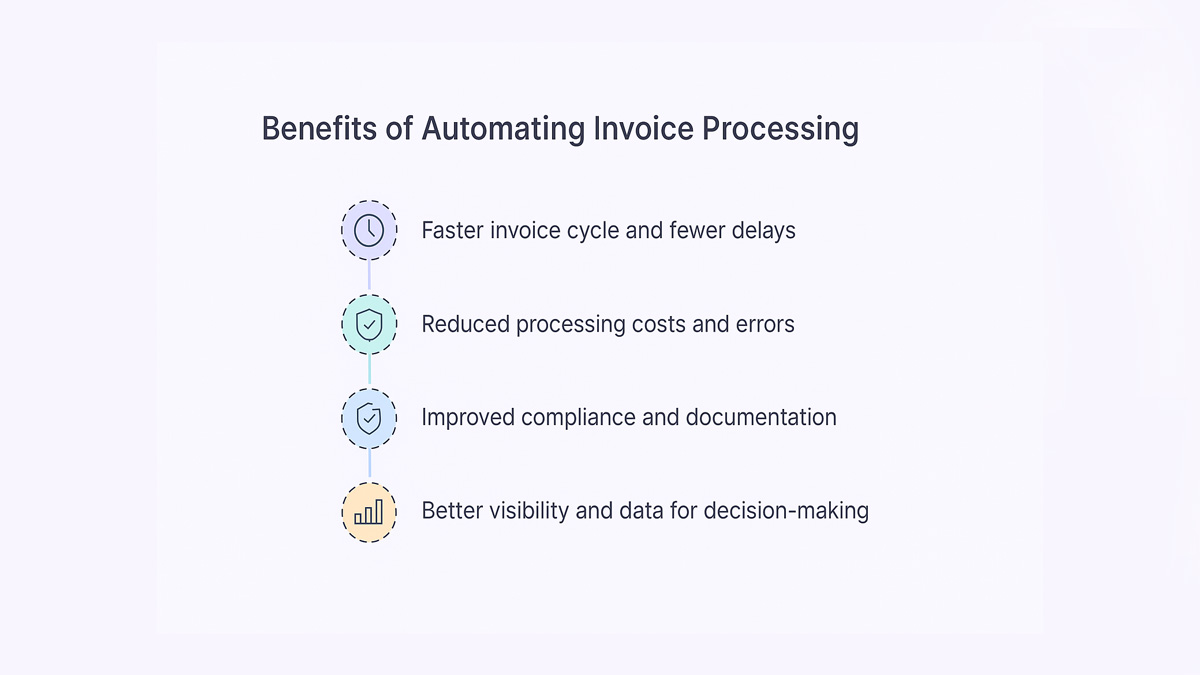

Benefits of Automating Invoice Processing in AP

Automation isn’t just a “nice-to-have” - it’s quickly becoming essential for AP teams that want to stay lean, compliant, and in control. Beyond time savings, it brings serious strategic value to the table. Let’s unpack the key benefits:

Faster Invoice Cycle and Fewer Delays

Automated workflows reduce lag at every step - from data entry to approvals and payment scheduling. Invoices move faster, meaning vendors get paid on time and your AP team isn’t constantly chasing down signatures or rechecking due dates.

Reduced Processing Costs and Errors

The cost to manually process a single invoice can be shockingly high - sometimes $15 or more. Add in the risk of late fees, duplicate payments, or human error, and it adds up fast. Automation minimizes manual intervention, lowering costs and cleaning up mistakes before they happen.

Improved Compliance and Documentation

With automation, every action is timestamped and recorded. No more digging through folders or email trails to find what happened and when. This level of transparency supports stronger internal controls and makes regulatory compliance - and audits - far less painful.

Better Visibility and Data for Decision-Making

When your invoice data lives in a centralized, searchable system, it opens up insights that were previously hard to capture. You can track expenses by vendor, forecast cash flow, and even spot trends that help you negotiate better terms - all in real time.

Smarter Invoice Management with Automation and Intelligence

Modern invoice management isn’t just about processing vendor invoices - it’s about making every step count. From invoice capture and invoice receipt to invoice payment and general ledger entry, smart tools streamline each stage. With the right invoice management software, teams can link every transaction back to the original purchase, reducing errors and improving cash flow management in real time.

Automated approval workflows powered by machine learning now flag anomalies, speeding up invoice approval while supporting fraud prevention. These systems not only enhance accuracy but also strengthen visibility across accounts receivable and accounts payable. By managing and processing invoices intelligently, businesses gain more control - and fewer headaches - over their financial operations.

How Spendflo Simplifies Invoice Processing in Accounts Payable

Spendflo helps finance and procurement teams take control of their entire invoice-to-pay process - without the usual chaos. By centralizing vendor contracts, automating approvals, and eliminating redundant steps, Spendflo shortens invoice cycles and boosts accuracy.

Real-time visibility lets you track every invoice status, while smart workflows ensure the right people approve the right payments at the right time. With reduced manual work, fewer errors, and clean audit trails, teams save both time and money. Whether you’re scaling fast or simply want more control, Spendflo turns invoice processing into a strategic advantage - not a backend burden.

Frequently Asked Questions on Invoice Processing in Accounts Payable

What are the main steps in AP invoice processing?

The typical invoice process includes receiving the invoice, logging it into the system, validating the details, routing for approval, matching it against purchase orders or receipts, processing the payment, and finally, archiving the records. Each step helps ensure accuracy, accountability, and timely payment.

How does automation help in invoice processing?

Automation removes the friction of manual tasks like data entry, approval routing, and invoice matching. It speeds up processing time, reduces human error, improves compliance, and gives teams better visibility into payment statuses - all while saving costs.

What causes delays in traditional invoice workflows?

Most delays happen due to missing information, slow approvals, data entry errors, or mismatches between invoices and purchase orders. Manual routing through email or paper trails can also create bottlenecks, especially when teams are working across locations.

How does invoice matching prevent errors?

Invoice matching compares key details across the invoice, purchase order (PO), and delivery receipt. It ensures you're only paying for goods or services that were actually ordered and received, helping prevent overpayments, duplicate payments, or fraud.

Is invoice automation suitable for small businesses?

Absolutely. In fact, small businesses often benefit the most from automation because it saves time, reduces administrative overhead, and scales with the company’s growth. Many tools today offer flexible, affordable options designed specifically for lean finance teams.

.png)

.png)

.png)