What Is ESG In Procurement? Definition, Practices & Examples (Explained)

What Is ESG In Procurement? Definition, Practices & Examples (Explained)

Explore the real costs of ESG in procurement and practical ways to reduce them without sacrificing sustainability goals.

When companies think about ESG (Environmental, Social, and Governance) in procurement, they often focus on the upside - better brand image, improved compliance, happier stakeholders. But behind the scenes, implementing ESG practices isn’t free. From supplier audits to sustainable sourcing, the hidden costs can pile up fast. And if not managed wisely, those well-intended ESG efforts might become financial sinkholes rather than strategic assets.

What is ESG in Procurement?

ESG in procurement refers to integrating environmental, social, and governance considerations into sourcing and supplier management. It ensures that purchases align with ethical, sustainable, and regulatory expectations across the supply chain.

Why ESG in Procurement Matters?

Here are the key reasons why ESG matters in procurement - it protects your brand, cuts long-term costs, ensures compliance, and strengthens stakeholder trust.

1. Protects Brand Reputation

Companies today are held to higher standards, not just by regulators but also by customers and investors. Ethical sourcing and sustainable practices show that your company walks the talk. A single ESG misstep - say, partnering with a supplier using unethical labor - can spark a PR crisis that damages trust and brand equity overnight.

2. Drives Long-Term Cost Efficiency

Although ESG initiatives may seem expensive upfront, they often lead to long-term savings. Think fewer compliance penalties, optimized resource usage, and lower energy costs. When you invest in ESG early, you’re essentially future-proofing your operations against rising regulatory costs and market pressure.

3. Ensures Regulatory Compliance

With evolving ESG-related laws like the EU’s Corporate Sustainability Reporting Directive (CSRD) and supply chain due diligence acts, non-compliance is no longer an option. Embedding ESG in procurement helps organizations stay ahead of audits and meet reporting requirements without scrambling at the last minute. Strong procurement processes help ensure alignment with evolving regulatory standards.

4. Attracts Investors and Stakeholders

ESG isn’t just a buzzword in boardrooms - it’s a green flag for investors. Procurement decisions that reflect solid ESG policies can boost investor confidence, attract funding, and even sway customer loyalty in your favor.

What Contributes to ESG Costs in Procurement?

Implementing ESG in procurement is a smart move - but it’s not a free one. Here are the areas where ESG-related expenses tend to show up most.

1. Supplier Audits and Certifications

To ensure your suppliers meet ESG standards, you’ll likely need to conduct audits - either through third parties or internal teams. These assessments require time, skilled personnel, and sometimes costly certifications like ISO 14001 or SA8000. Multiply that by dozens or even hundreds of vendors, and the numbers add up fast.

2. ESG Reporting and Documentation

Regulatory bodies, investors, and customers want transparency. That means detailed ESG reports, sustainability disclosures, and impact metrics. Gathering, verifying, and presenting this data isn’t just a paperwork task - it demands tools, time, and often dedicated compliance personnel.

3. Sustainable Sourcing Practices

Eco-friendly materials, fair trade goods, and low-carbon logistics often carry a premium. Materials like recycled plastics are increasingly being prioritized for procurement. While the long-term ROI may be worth it, the upfront procurement cost can be significantly higher than traditional options - especially for companies still transitioning away from cost-first sourcing.

4. Compliance and Legal Monitoring

New ESG laws are rolling out across regions - and they vary. These regulatory changes are reshaping how global procurement functions operate. Keeping up requires legal oversight, regular updates to supplier contracts, and sometimes even risk assessments. That means ongoing legal support or in-house resources, which adds another line item to your ESG cost sheet.

How to Control ESG Procurement Costs?

While ESG adds cost, it doesn’t have to drain your budget. The key is balancing principles with practicality. Here are a few ways to make your ESG strategy leaner and more efficient.

1. Prioritize High-Impact Categories

Instead of trying to apply ESG standards across every single procurement item, focus on high-spend or high-risk categories first - like logistics, raw materials, or packaging. This allows you to channel resources where they matter most, both financially and environmentally.

2. Set Realistic ESG Goals

Ambition is great, but setting ESG targets that are too lofty can backfire - resulting in wasted spend and missed KPIs. Start with achievable milestones that still make an impact. Revisit and scale up once your processes mature.

3. Build ESG Into Supplier Scorecards

Rather than treating ESG as an add-on, bake it into your existing supplier evaluation process. Score vendors on ESG metrics alongside cost and delivery performance. Many procurement teams are now tracking diversity spend as part of ESG evaluations. This encourages better practices without creating a parallel, expensive evaluation system.

4. Invest in Training and Awareness

A well-informed procurement team can make ESG-aligned choices without constant oversight. Training programs, playbooks, and workshops help reduce dependency on external consultants - and keep your team aligned on goals and budget constraints. Inclusive hiring practices also contribute to ESG goals in procurement.

5. Leveraging Circular Economy Models

Circular economy thinking isn’t just for sustainability reports - it’s a practical lever for reducing ESG costs while improving operational efficiency. These models contribute significantly to Environmental Protection goals. Instead of the traditional “take-make-dispose” model, the circular approach emphasizes reuse, repair, recycling, and resource optimization.

For procurement teams, this can mean sourcing products with longer life cycles, prioritizing modular or recyclable components, or working with vendors who offer reverse logistics. By looping materials back into the system, companies can reduce raw material costs, cut waste disposal fees, and lower their environmental footprint - all while strengthening their ESG performance.

It also helps optimize resources throughout the product life cycle. It’s smart, sustainable, and increasingly expected by stakeholders.

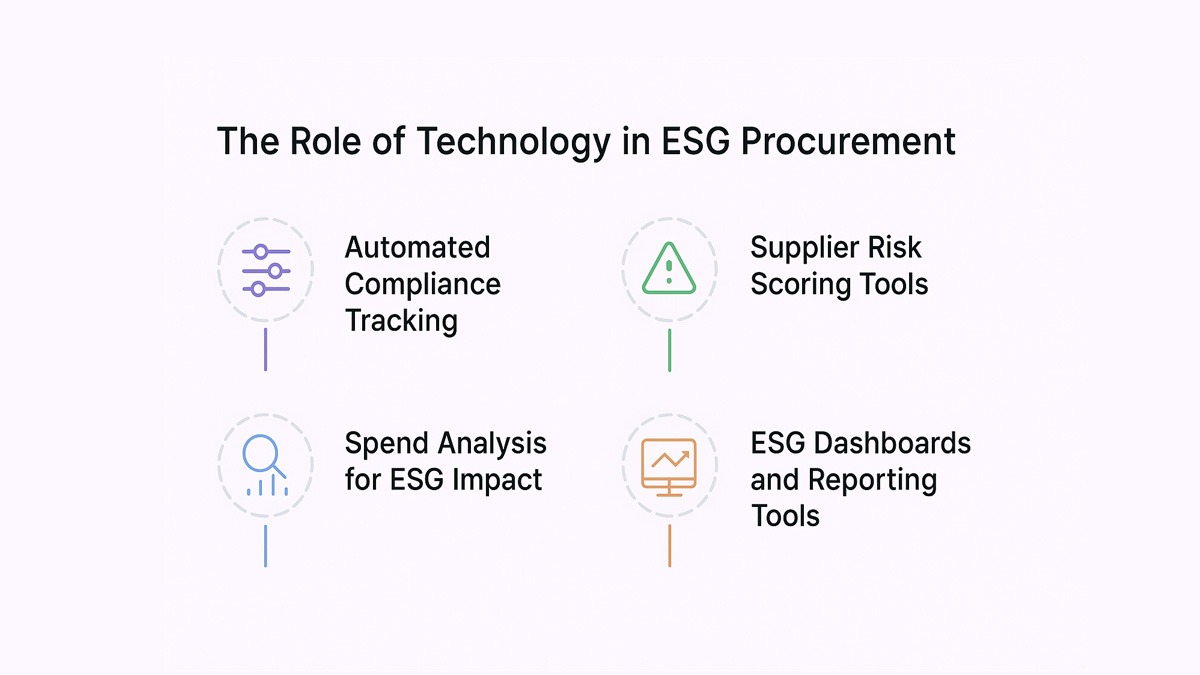

The Role of Technology in ESG Procurement

Technology isn’t just a support system for ESG - it’s the engine that keeps it running efficiently. Tools that enable digital orchestration are key to scalable ESG performance. ESG compliance is increasingly tied to broader digital transformation initiatives. Here’s how the right tools can dramatically reduce ESG costs while improving control, transparency, and outcomes.

1. Automated Compliance Tracking

Regulations change fast. Instead of manually updating compliance documents or checking vendor certifications, automated tools can track requirements in real-time. They alert procurement teams to new ESG risks, flag expired documents, and keep you ahead of audits without burning hours on admin work.

2. Supplier Risk Scoring Tools

Modern platforms can assess supplier ESG performance using real-time data, public disclosures, and industry benchmarks. These tools assign scores for environmental impact, labor practices, and governance risks - so you can spot red flags before they become costly problems.

Incorporating risk analytics can further refine ESG scoring models. Plus, it’s a scalable way to vet hundreds of vendors without manual legwork.

3. Spend Analysis for ESG Impact

Not all spend is equal when it comes to ESG. AI-powered spend analytics platforms can tag and categorize expenses based on sustainability criteria - revealing which categories are driving emissions, waste, or social risks. Procurement leaders are also using these insights to measure non-financial KPIs.

This visibility helps teams prioritize sustainable alternatives without relying on gut feel or scattered data. These metrics will be central to many procurement KPIs in the 2026 report.

4. ESG Dashboards and Reporting Tools

Having the right data is one thing. Making it usable - and reportable - is another. ESG dashboards consolidate supplier data, impact metrics, and compliance status in one view. This simplifies reporting to stakeholders, supports regulatory filings, and cuts down on the time and cost of preparing sustainability reports.

How Spendflo Helps with ESG-Driven Procurement

Managing ESG in procurement can feel like juggling fire - especially when you’re also chasing savings, renewals, and compliance. That’s where Spendflo steps in. With centralized procurement visibility, Spendflo helps you monitor vendor performance, automate contract workflows, and enforce ESG-aligned policies without slowing down business.

By giving you real-time insights into vendor ESG metrics and procurement spend, Spendflo ensures that every contract renewal or new purchase aligns with your sustainability goals. Plus, with built-in negotiation support, you’re not just going green - you’re also staying lean.

Ready to move to a green procurement environment? Book a demo with Spendflo today.

Frequently Asked Questions on ESG in Procurement

What are common ESG costs in procurement?

Typical ESG costs include supplier audits, certifications, sustainable material premiums, legal compliance tracking, and ESG reporting infrastructure.

How can procurement teams reduce ESG-related expenses?

Start by prioritizing high-impact categories, automating ESG compliance tracking, and integrating ESG into existing supplier scorecards instead of creating parallel systems.

Why is ESG important in supplier selection?

ESG-compliant suppliers help reduce risk, support brand reputation, and ensure compliance with emerging regulations - making them essential for sustainable growth.

Can ESG initiatives improve procurement ROI?

Yes, especially over the long term. ESG efforts reduce regulatory risk, increase supply chain resilience, and can unlock investor interest - leading to better overall returns.

.png)

.png)