16 Best Cash Flow Management Software Solutions for 2025

16 Best Cash Flow Management Software Solutions for 2025

Compare 16 top-rated cash flow tools for 2025. Discover features, use cases, and the best fit for your business stage and size.

Cash flow is the lifeblood of any business - yet, nearly 82% of startups fail because of poor cash flow management, according to a US Bank study. Even profitable businesses can spiral into financial distress if they’re not monitoring their inflows and outflows closely. With rising costs, global uncertainty, and distributed teams, managing liquidity has never been more critical. That’s where modern cash flow software steps in - offering clarity, control, and confidence.

What this blog covers:

- What are cash flow management tools?

- Top cash flow management software tools in 2025

- Key features to look for in a cash flow management solution

- Choosing the right cash flow tool for your business stage and size

- How Spendflo helps with cash flow visibility and optimization

- Frequently asked questions on cash flow management solutions

What Are Cash Flow Management Tools?

Cash flow management tools are software solutions designed to track, forecast, and optimize a business’s cash inflows and outflows. They help finance teams monitor real-time liquidity, manage accounts payable and receivable, and plan for short- and long-term financial obligations - all in one place.

Top Cash Flow Management Software Tools in 2025

Managing cash flow today isn’t about staring at spreadsheets and guessing your runway. It’s about tapping into real-time data, forecasting with accuracy, and getting a clear pulse on your liquidity - daily, not monthly. Whether you’re a startup looking to stretch capital or an enterprise steering global operations, the right tool can make or break your financial rhythm.

Here are 16 of the top-rated cash flow management software tools businesses are turning to in 2025.

1. Float

Float simplifies cash flow forecasting by syncing directly with your accounting software to deliver real-time insights. It’s highly visual and intuitive, making it a go-to for small businesses and finance teams who want quick answers without financial modeling headaches.

Best for: Small businesses and agencies that want simple, accurate forecasting.

Key Features:

- Real-time cash flow updates synced with Xero, QuickBooks, and FreeAgent

- Scenario planning and “what-if” forecasting

- Drag-and-drop cash flow calendars

- Budgeting tools with historical trend analysis

2. QuickBooks

QuickBooks is a household name in small business accounting - and for good reason. Its built-in cash flow planner gives users a running forecast of available funds, integrated with invoices, bills, and bank feeds.

Best for: Freelancers, solopreneurs, and small business owners.

Key Features:

- Automated cash flow forecasting and tracking

- Real-time insights into income, expenses, and bank balances

- Integration with over 650 financial apps

- Alerts for low cash or overdue payments

3. Upflow

Upflow is a modern cash flow and receivables management platform that helps businesses foster financial relationships with their customers by streamlining accounts receivable and making the payment experience smoother.

Best for: B2B companies looking to reduce DSO and strengthen customer relationships through better AR management and payment experiences.

Key Features:

- Automated, personalized, multi-channel payment reminders

- White-labelled payment portals with ACH, card payments, Autopay and much more

- Smart cash application with AI-powered invoice matching

- Collaborative workflows for finance, sales, and customer success teams

- Seamless integrations with NetSuite, QuickBooks, Xero, and other accounting tools

4. CashFlow Frog

Built specifically for cash flow forecasting, CashFlow Frog offers visual, scenario-based forecasting for businesses of all sizes. It supports long-term planning and presents forecasts in ways even non-finance teams can understand.

Best for: Finance teams needing interactive, visual cash flow dashboards.

Key Features:

- Direct sync with QuickBooks and Xero

- Automated short- and long-term forecasting

- Scenario modeling with multiple variables

- Custom dashboards and white-label options for advisors

5. Planful

Planful is a powerful FP&A platform built for larger finance teams that need robust modeling and strategic planning capabilities. It goes beyond basic forecasting and brings cash flow into broader financial performance analysis.

Best for: Mid-market to enterprise finance teams with FP&A needs.

Key Features:

- Advanced financial modeling and planning workflows

- Real-time collaboration between FP&A and business units

- Scenario analysis for liquidity planning

- Integration with ERP, CRM, and HR systems

6. Cube

Cube is a modern FP&A tool that lives inside your spreadsheets. It enhances Excel and Google Sheets with centralized data, audit trails, and forecasting automation - giving analysts power without pulling them out of their favorite tools.

Best for: Fast-scaling finance teams who love spreadsheets but need control.

Key Features:

- Two-way sync with spreadsheets and source systems

- Multi-scenario forecasting and variance analysis

- Role-based access and collaboration workflows

- Real-time cash flow visibility

7. Pulse

Pulse is designed for entrepreneurs and agencies who need easy cash flow control without enterprise-level overhead. It’s minimal, visual, and focused on daily cash needs.

Best for: Freelancers, founders, and agency owners.

Key Features:

- Manual or automatic forecasting

- Multiple cash flow views (daily, weekly, monthly)

- Client and project-level income tracking

- Custom categorization of expenses

8. Agicap

Agicap provides a powerful yet simple cash flow forecasting platform tailored for SMBs across Europe. It connects to banks and accounting tools, offering daily liquidity insights.

Best for: European small to medium-sized businesses.

Key Features:

- Bank sync with automatic categorization of transactions

- Forecasting by business unit or location

- Expense breakdowns by vendor and category

- Real-time budget vs. actual tracking

9. Xero

While Xero is known as accounting software, its real-time cash flow and liquidity tracking features make it a top contender for financial visibility. It’s clean, cloud-based, and designed for ease.

Best for: Small businesses seeking all-in-one bookkeeping and cash flow insights.

Key Features:

- Real-time cash tracking with bank reconciliation

- Detailed financial reports.

- Automated invoice and bill workflows

- Financial dashboard with cash inflow/outflow insights

- Add-ons for forecasting and analytics

10. FreshBooks

FreshBooks combines accounting and cash flow forecasting in a user-friendly interface designed for non-finance professionals. It’s ideal for freelancers and service-based businesses.

Best for: Creative professionals and small service businesses.

Key Features:

- Time tracking and invoicing with automatic follow-ups

- Basic cash flow reports and estimates

- Client expense tracking and categorization

- Mobile-first UI for quick access

11. Tesorio

Tesorio is purpose-built for managing receivables and cash forecasting in real time. It connects deeply with ERPs and helps mid-sized to large companies optimize working capital.

Best for: B2B companies with long AR cycles and liquidity concerns.

Key Features:

- AR forecasting with predictive analytics

- Integration with NetSuite and Oracle

- Automated follow-ups and collections workflows

- Custom alerts for overdue payments

12. Workday Adaptive Planning

A robust enterprise solution, Adaptive Planning (by Workday) delivers financial modeling, workforce planning, and detailed scenario analysis - all scalable for global finance operations.

Best for: Large enterprises and FP&A teams.

Key Features:

- Dynamic scenario planning for cash flow and budgets

- Integration with HR, ERP, and CRM platforms

- Role-based dashboards and planning access

- Global compliance support

13. Sage Intacct

Sage Intacct is a cloud-native financial management platform that offers deep accounting and real-time cash visibility. It’s especially powerful in the SaaS and services industries.

Best for: Finance leaders in high-growth SaaS or services companies.

Key Features:

- Automated multi-entity and multi-currency consolidation

- Real-time general ledger and cash views

- Custom financial dashboards and KPIs

- Integration with Salesforce and budgeting tools

14. Anaplan

Anaplan is a cloud-native platform for connected planning - from finance to HR to sales. Its robust modeling engine is designed for enterprises that need enterprise-grade cash flow planning.

Best for: Enterprises with large, matrixed planning needs.

Key Features:

- Cash flow modeling and strategic scenario planning

- Multi-department financial alignment

- AI/ML-driven predictive analytics

- Dynamic liquidity tracking across geographies

15. Kyriba

Kyriba is a treasury and cash management solution built for large enterprises and CFOs. It helps teams manage liquidity, hedge currency risks, and maintain financial stability globally.

Best for: Global companies needing treasury-level control.

Key Features:

- Bank connectivity and real-time liquidity data

- FX risk management and cash positioning

- Payment fraud detection, compliance tools

- Streamlined treasury processes

- Treasury dashboards and analytics

16. Zeni

Zeni is a smart finance platform powered by AI that offers bookkeeping, forecasting, and

real-time cash flow insights specifically for startups.

Best for: Startups looking for all-in-one finance automation.

Key Features:

- Daily bookkeeping and cash flow tracking

- FP&A insights in real time

- Fundraising runway and burn analysis

- Consolidated financial dashboards

17. Oracle NetSuite

Oracle NetSuite is a powerhouse ERP that includes advanced cash flow analytics, automation, and planning capabilities. It’s ideal for scaling companies who need full financial infrastructure.

Best for: Fast-scaling companies moving toward enterprise-grade finance.

Key Features:

- Real-time cash flow forecasts and alerts

- Deep integration across departments (CRM, HR, ERP)

- Custom scenario planning

- Multi-subsidiary financial management

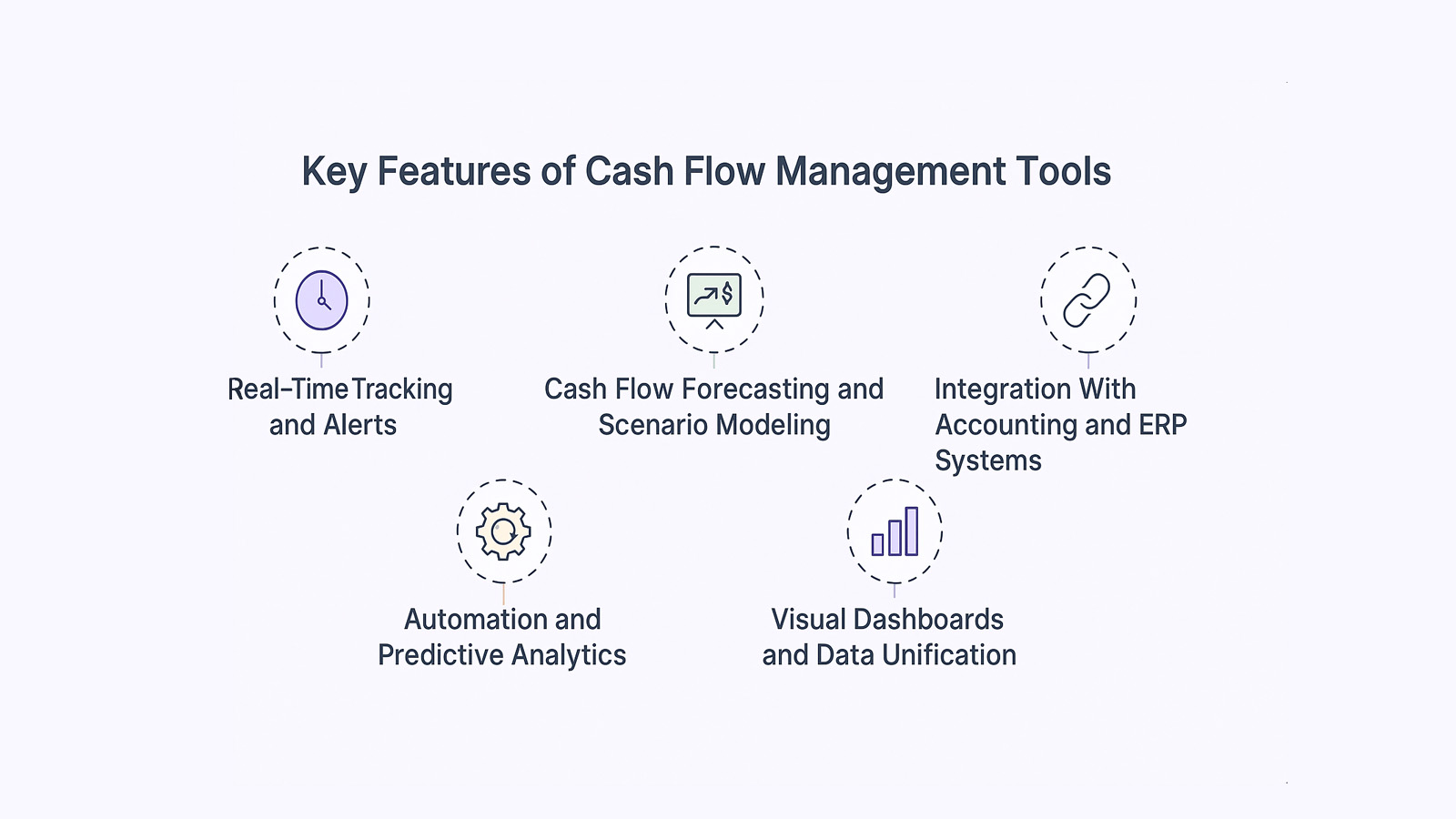

Key Features to Look for in a Cash Flow Management Solution

Not every tool fits every team - but some features are non-negotiable. Here’s what to prioritize when picking your cash flow software:

Real-Time Tracking

Instant visibility into bank balances, inflows, and outflows. This gives finance teams real-time visibility into their liquidity position.

Forecasting, Scenario Modeling, & Liquidity Management

Plan for best- and worst-case situations with “what-if” simulations. Plan for best- and worst-case situations with "what-if" simulations to protect cash reserves.

ERP & Accounting Integrations

Sync data from QuickBooks, NetSuite, Xero, and more - no manual uploads. Many tools also integrate directly with ERP systems to streamline data flow.

Automation & Alerts

Automated workflows for invoicing, reminders, and smart notifications. Some platforms also enable automated payments to vendors.

Real-time Dashboards

Simple charts and KPIs that make financial data easy to read and act on. Many dashboards also support cash flow analysis with customizable metrics.

These features combine to give you clarity, control, and confidence in your cash position - both now and in the future. They also help streamline financial operations across teams.

Choosing the Right Cash Flow Tool for Your Business Stage and Size

Cash flow needs aren’t one-size-fits-all. Your ideal tool should match your company’s size, complexity, and growth stage. Here’s a quick guide to help you choose smart.

Startups and Small Businesses

Look for tools that are simple, budget-friendly, and easy to set up - like Float or Pulse. You’ll want fast insights without a steep learning curve.

Scaling Mid-Sized Companies

Mid-stage companies benefit from more control. Tools like Cube or Agicap support department-level budgets and stronger forecasting capabilities.

Enterprises and Multinational Organizations

Global companies need robust planning and deep integration. Platforms like Anaplan or NetSuite handle multiple entities, currencies, and compliance needs. These tools also support complex treasury management workflows.

FP&A and Finance-Led Teams

If you have a dedicated finance team, go for modeling-heavy tools like Planful or Workday Adaptive Planning to support strategic forecasting.

Remote or Distributed Teams

Choose cloud-first platforms like Xero or Zeni for real-time access, seamless collaboration, and team-wide visibility - no matter the timezone.

How Spendflo Helps With Cash Flow Visibility and Optimization

Spendflo helps finance teams gain complete visibility into spend, renewals, and vendor contracts - a key part of managing cash outflows. By centralizing software expenses and streamlining procurement, it frees up working capital, prevents surprise renewals, and ensures every dollar spent aligns with business priorities.

Frequently Asked Questions on Cash Flow Management Solutions

What is the best cash flow software for small businesses?

Tools like Float, QuickBooks, and Pulse are popular with small businesses for their simplicity, affordability, and real-time forecasting features. They’re easy to use and don’t require a full finance team to manage.

Can cash flow tools help avoid insolvency or financial distress?

Yes. These tools provide visibility into upcoming cash shortages, helping businesses proactively adjust spend, delay outflows, or accelerate receivables - reducing the risk of unexpected financial trouble.

What features are essential for accurate cash flow forecasting?

Real-time data sync, scenario modeling, and historical trend analysis are essential. These forecasts are often powered by custom cash flow models. The ability to test “what-if” scenarios and adjust forecasts based on dynamic inputs makes forecasting more reliable.

Are cloud-based cash flow solutions secure?

Most modern tools follow strict security protocols, including data encryption, access controls, and regular audits. Always choose vendors that are SOC 2 compliant or offer enterprise-grade security features.

How do these tools support accounts receivable and payable tracking?

Many platforms integrate with your accounting system to automatically track open invoices, due payments, and vendor bills. Some even send automated reminders or alerts to help you manage AR/AP efficiently.

.png)

.png)

.png)