Accounts Payable Reporting: The Complete Guide

Accounts Payable Reporting: The Complete Guide

Learn key AP reports, best practices, and real-time tools to improve accounts payable visibility and decision-making.

When cash leaves a company, it rarely does so quietly. Missed payments, duplicate invoices, or surprise liabilities, these are the kinds of hiccups that create chaos in finance. Accounts payable reporting helps prevent that chaos by turning raw payment data into clear, actionable insights. It’s not just a routine task, it’s a window into your financial health.

What this blog covers:

- What is accounts payable reporting

- The most commonly used AP reports in finance

- How AP reporting improves decision-making and cash flow visibility

- Best practices to streamline accounts payable reporting

- The impact of real-time AP reporting tools on efficiency

- How Spendflo helps optimize your accounts payable process

- Frequently asked questions on accounts payable reporting

What Is Accounts Payable Reporting?

Accounts payable reporting is the process of tracking, analyzing, and presenting data related to outstanding bills, vendor payments, and invoice status. It gives finance teams visibility into what the company owes, to whom, and when, helping them plan payments, forecast cash flow, and avoid costly mistakes.

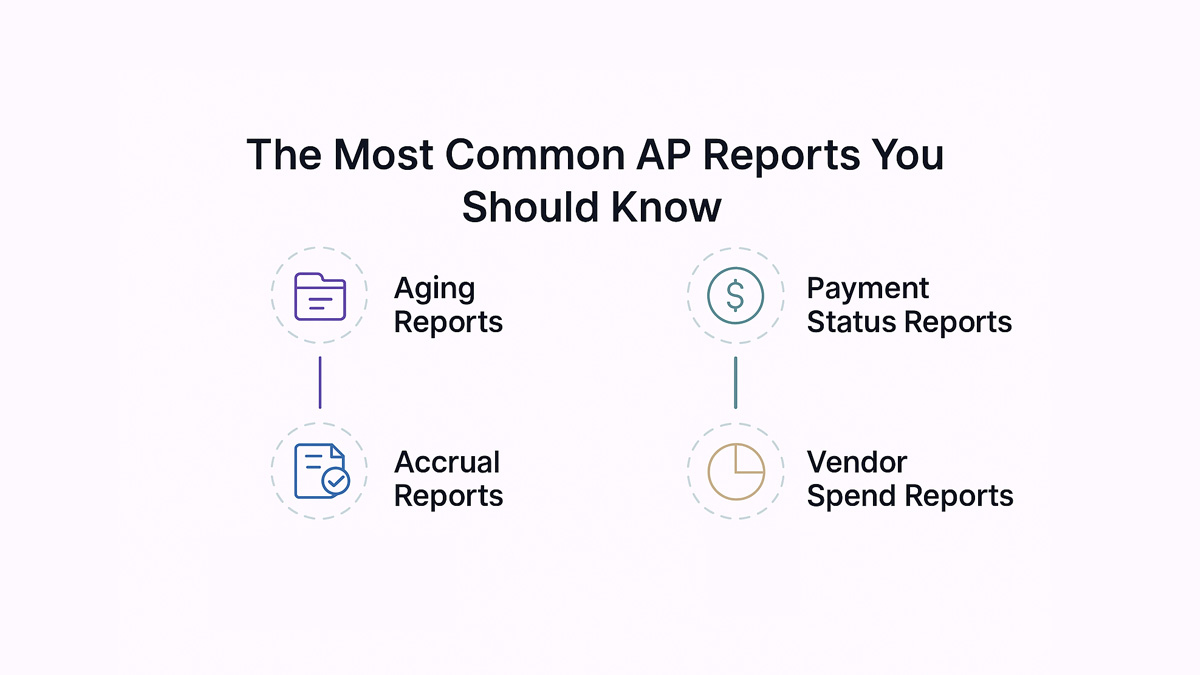

The Most Commonly Used AP Reports You Should Know

AP reporting isn’t just about crunching numbers, it’s about knowing which numbers matter. Different reports serve different purposes, from managing vendor relationships to staying audit-ready. Here are the key reports every finance team should keep on their radar:

Aging Reports

These show outstanding payables categorized by due dates, like current, 30, 60, or 90+ days overdue. Aging reports help identify which invoices need urgent attention and ensure vendors are paid on time to avoid late fees or strained relationships.

Payment Status Reports

These summarize all invoices and their current payment status: paid, unpaid, pending approval, or overdue. A vendor invoice with missing details can often cause bottlenecks in the payment cycle. It’s a quick way to assess where money is tied up in the pipeline and prioritize processing accordingly.

Accrual Reports

These track expenses that have been incurred but not yet paid. Accrual reports are essential during month-end or year-end closing to match expenses to the correct reporting period and maintain financial accuracy.

Vendor Spend Reports

These reports break down spending by vendor over a set period. They’re invaluable for negotiations, budgeting, and identifying any vendor dependency or spend leakage you might otherwise overlook.

How AP Reporting Supports Better Financial Decision-Making

Accounts payable reports aren’t just for bean counters, they’re strategic tools that help leadership steer the company with confidence. When you know where your money’s going, you’re in a better position to plan, react, and grow. Here’s how smart AP reporting fuels smarter decisions:

Improves Cash Flow Visibility

Seeing upcoming payments in advance allows finance teams to anticipate cash needs and avoid crunches. This kind of foresight helps ensure smooth operations and prevents scrambling for funds last minute.

Enables Accurate Forecasting

By analyzing historical payment patterns and future obligations, businesses can forecast with greater accuracy. It helps finance teams allocate funds wisely, prepare for seasonal fluctuations, and reduce financial guesswork. Timely AP reporting also supports more efficient payment processing across departments.

Strengthens Supplier Relationships

Consistent, timely payments build trust with vendors. AP reports help identify payment delays or patterns of inconsistency, so you can fix issues before they damage relationships or cause supply chain disruptions.

Supports Compliance and Audit Readiness

With proper AP reporting, every transaction is traceable. This ensures you’re ready when auditors come knocking, reduces the risk of non-compliance, and helps meet internal control standards with confidence. Thorough invoice verification processes help detect discrepancies before they impact financial records.

Best Practices for Accounts Payable Reporting

Good AP reporting isn’t just about collecting data, it’s about making that data reliable, consistent, and useful. When reporting is clean and aligned with business goals, it becomes a decision-making powerhouse. Here are some best practices to follow:

Standardize Data Entry and Categories

Inconsistent data entry is one of the biggest causes of reporting errors. Use predefined fields, vendor codes, and invoice categories to maintain accuracy and simplify report generation.

Leverage Automation Tools

Manual entry leads to missed invoices and late payments. Automation tools help capture data in real time, reduce human error, and ensure reports are always up to date.

Schedule Regular Reporting Cycles

Don’t wait for the end of the month. Weekly or even daily reporting can uncover issues before they snowball. Streamlining invoice approvals can help reduce delays and improve reporting accuracy. Set clear cycles so that finance teams stay ahead of the curve.

Align Reports With Business KPIs

Customize your AP reports to reflect what’s important to your business, whether it’s vendor discounts, cash position, or payment turnaround time. Data without context rarely drives action.

Improving Your AP Process With Real-Time Reporting Tools

The faster you see what’s happening in your AP pipeline, the faster you can act. Real-time reporting tools bring speed, clarity, and accuracy to accounts payable, making them essential for modern finance teams. Here’s how they help:

Eliminate Manual Errors

Real-time tools reduce the need for manual data input. This significantly lowers the risk of invoice errors and duplicate payments. This means fewer mistakes, faster turnaround, and less time spent fixing issues caused by human error.

Enable Proactive Spend Management

Instead of reacting to issues, you can spot trends early. Real-time visibility into vendor spend or overdue invoices helps you make course corrections before small problems become big ones.

Track KPIs in Real Time

Need to know your DPO (Days Payable Outstanding) or late payment rate right now? Real-time dashboards keep performance metrics updated, helping teams make data-backed decisions instantly.

Integrate With ERP and Finance Tools

Most real-time reporting platforms sync easily with ERP systems, procurement tools, and accounting software. This creates a seamless flow of information, reduces silos, and gives you a 360° view of payables.

How Spendflo Helps With Accounts Payable Optimization

Spendflo empowers finance and procurement teams by bringing visibility, control, and efficiency into the AP process. By centralizing vendor contracts, automating renewal workflows, and syncing real-time spend data across tools, Spendflo makes AP reporting faster, cleaner, and more actionable. It also supports by linking purchase orders with delivery receipts and invoices seamlessly. No more surprises, just reliable insights that help you stay ahead of your payables.

Frequently Asked Questions on accounts payable reporting

What are the most essential accounts payable reports?

Aging reports, payment status reports, vendor spend summaries, and accrual reports are the most commonly used. Each serves a different purpose, from tracking overdue invoices to forecasting financial obligations. Managing supplier invoices effectively is critical to maintaining accurate reporting.

How often should AP reports be generated?

While month-end reports are standard, high-growth or high-spend businesses benefit from weekly or even daily AP reporting. The frequency should match your business complexity and cash flow needs.

How does automation improve AP reporting accuracy?

Automation reduces manual data entry errors, ensures timely updates, and keeps reports consistent. It also enables real-time visibility into payments, approvals, and invoice statuses across systems.

What are common mistakes to avoid in AP reporting?

Some of the most frequent pitfalls include inconsistent data entry, missing vendor information, lack of integration with ERP systems, and not aligning reports with business KPIs or compliance needs.

.png)

.png)

.png)