Trade Payables Explained: A Primer with Examples

Trade Payables Explained: A Primer with Examples

Learn what trade payables are, how they work, and how to manage them effectively using modern tools and best practices.

Ever found yourself waiting on a payment while juggling your own bills? That’s the balancing act businesses perform every day, especially when managing trade payables. These aren’t just accounting entries; they’re the lifeblood of vendor relationships, cash flow, and procurement strategy. When managed right, trade payables can help businesses grow without burning cash upfront. They also play a pivotal role in maintaining a resilient supply chain by keeping vendor partnerships stable. Mismanaged? They become a silent killer of financial health.

What this blog covers:

- What trade payables are and how they function in business operations

- Why trade payables are crucial for liquidity and financial management

- The key benefits and risks of using trade payables for procurement

- Differences between trade payables and accounts payable

- How technology is transforming trade payables workflows

- Best practices for managing trade payables efficiently

- How Spendflo helps streamline and optimize trade payables

- Frequently asked questions on trade accounts payable

What Are Trade Payables and How Do They Work?

Trade payables refer to the amount a company owes its suppliers for goods or services purchased on credit. These are short-term liabilities that appear on the balance sheet under current liabilities. They represent a critical part of the procurement and cash flow process, allowing businesses to delay payments while maintaining operations and preserving liquidity.

Why Trade Payables Are Important

When cash is tight and deadlines are looming, trade payables give businesses breathing room. They allow companies to acquire goods or services without immediate payment, freeing up working capital for more urgent needs like payroll, marketing, or growth initiatives. More than just a payment delay, they act as a built-in line of credit from suppliers. Negotiating favorable credit terms can further extend liquidity and improve financial flexibility. When managed responsibly, this credit builds vendor trust, strengthens negotiation power, and contributes to healthier cash flow cycles. But when neglected, unpaid invoices can damage relationships and credit ratings. In short, trade payables aren’t just about deferring payment, they’re a strategic tool for financial agility. Balancing trade payables with trade receivables ensures smoother cash flow across the business cycle.

The Benefits and Risks of Relying on Trade Payables

Trade payables can be both a strategic advantage and a hidden liability, it all depends on how they’re managed. When used wisely, they support cash flow and supplier relationships. But when misused or ignored, they can spiral into operational and reputational risks. Here’s a look at both sides of the coin.

Cash Flow Flexibility

Trade payables give businesses the breathing space they need. By deferring payments, companies can keep more cash on hand to cover urgent expenses, invest in growth, or weather seasonal fluctuations. This flexibility is especially useful for startups or businesses with uneven revenue cycles.

Better Supplier Terms

Consistently meeting payment terms builds trust. Over time, this can lead to extended payment windows, volume discounts, or priority treatment during supply shortages. In competitive industries, these advantages can directly impact profitability and operational efficiency.

Overreliance Risk

Leaning too heavily on trade payables can backfire. If a business habitually delays payments beyond agreed terms, it can strain supplier relationships or even lead to service disruptions. Suppliers may begin demanding upfront payments or stop doing business altogether.

Credit Reputation Impact

Late or missed payments don’t just hurt relationships, they can damage a company’s credit profile. A poor reputation in the supplier ecosystem can limit future access to favorable terms, and in some cases, impact the company’s ability to raise financing or secure partnerships.

Trade Payables vs. Accounts Payable: Key Differences

The terms trade payables and accounts payable are often used interchangeably, but they’re not identical. Understanding the distinction helps finance and procurement teams stay organized, especially when categorizing liabilities or preparing accurate financial reports. Here’s how they differ across key areas:

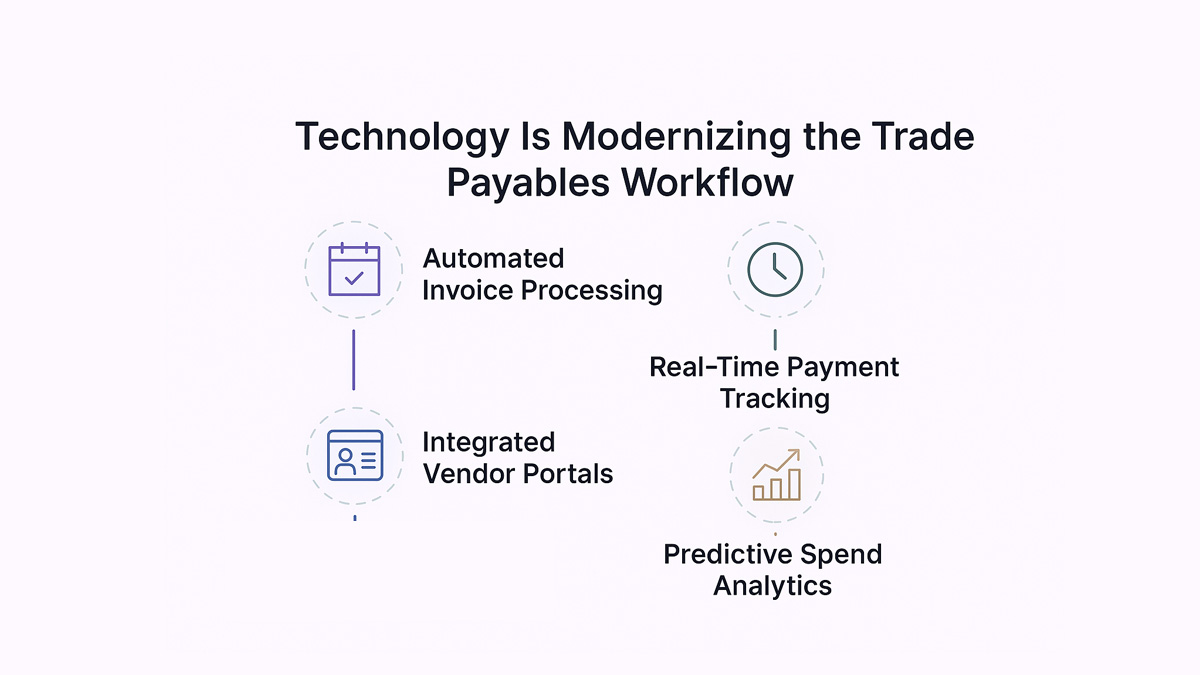

Technology Is Modernizing the Trade Payables Workflow

Managing trade payables used to mean chasing paper trails and cross-checking spreadsheets. Not anymore. Digital tools are redefining how businesses handle their payables, making processes faster, more accurate, and far less painful. The right tech stack doesn’t just automate tasks; it brings control, transparency, and agility into every payable decision.

Automated Invoice Processing

Manually entering invoice data is time-consuming and error-prone. Modern tools use OCR (optical character recognition) and AI to capture invoice details instantly, flag discrepancies, and even auto-approve recurring expenses based on pre-set rules.

Real-Time Payment Tracking

No more guesswork on whether a payment was made or received. Real-time dashboards give finance teams complete visibility into due dates, pending approvals, and cash outflows, helping avoid late fees or strained supplier relations.

Integrated Vendor Portals

Vendors can now submit invoices, check payment statuses, and resolve disputes through self-serve portals. This reduces back-and-forth emails and gives vendors more confidence in your process.

Predictive Spend Analytics

AI-driven analytics can forecast future payables, flag anomalies, and recommend early payment discounts. These insights help teams plan better, negotiate smarter, and stay proactive instead of reactive. Over time, efficient payables management directly contributes to long-term financial stability.

Best Practices for Managing Trade Payables Efficiently

Trade payables aren’t just about paying bills on time, they’re a strategic function that can impact cash flow, supplier relationships, and operational agility. A well-oiled payables process doesn’t happen by accident. It takes a mix of structure, visibility, and tech. Here’s how leading finance teams keep things running smoothly.

Centralize Purchase Order and Invoice Management

Disparate systems lead to duplicate orders, missed payments, or untracked liabilities. Centralizing all purchase orders and invoices into a single system helps maintain control, reduce errors, and streamline audit trails.

Implement a Clear Approval Workflow

Without a structured approval process, payments can slip through without scrutiny, or worse, get stuck in bottlenecks. Define who approves what, when, and under which conditions. Automating this can speed things up without losing control.

Prioritize Supplier Communication

Delayed payments or unexpected changes frustrate vendors. Proactive, transparent communication around payment timelines, disputes, or delays keeps relationships strong and prevents supply disruptions. Regularly reconciling supplier statements helps avoid mismatches and strengthens trust.

Track KPIs and Aging Reports

Monitor key metrics like Days Payable Outstanding (DPO), average payment time, and aging reports. These data points reveal payment trends, highlight process inefficiencies, and help teams make smarter cash flow decisions.

How Spendflo Helps With Trade Payables Optimization

Spendflo streamlines the trade payables process by giving businesses full visibility into SaaS and vendor spend, all in one place. From consolidating procurement data to managing renewals and vendor payments, it eliminates guesswork and manual follow-ups. With built-in workflows and real-time insights, finance teams can avoid missed payments, reduce redundant tools, and negotiate better terms. The result? Optimized cash flow, fewer surprises, and stronger vendor relationships.

Frequently Asked Questions on Trade Accounts Payable

What is the difference between trade payables and bills payable?

Trade payables are short-term debts to suppliers for goods and services used in day-to-day operations. Bills payable are more formal obligations, like promissory notes, often tied to financing or loans.

How can businesses reduce late payments in trade payables?

Automating invoice approvals and setting internal SLAs helps ensure payments are processed on time. Real-time dashboards and reminders also keep teams on track with due dates and cash flow planning.

What tools help automate trade payables?

Platforms like Spendflo, Coupa, and Tipalti automate tasks like invoice capture, approval routing, and payment scheduling. These tools reduce manual work and improve accuracy across the payables process.

Are trade payables considered current liabilities?

Yes, trade payables are listed under current liabilities on a company’s balance sheet. They indirectly influence the income statement by shaping cost of goods sold and expense timing. They usually need to be paid within 30 to 90 days of invoicing. Each payable is typically recorded through a journal entry to ensure proper tracking in the ledger.

.png)

.png)

.png)