Spendflo and NetSuite: From Request to PO

Spendflo and NetSuite: From Request to PO

PO mismatches happen when finance sees spend too late. Spendflo x NetSuite fixes this by automatically creating NetSuite POs the moment requests are approved.

I"I love spending hours fixing PO mismatches" — said no one ever.

Yet here we are. Finance departments spend close to 25% of their time correcting data inaccuracies, including PO-to-invoice mismatches.

The result? Month-end chaos, audit nightmares, and spending that slips through the cracks before you even know it exists.

The real problem isn’t the mismatches. It’s that purchases happen before you can control them.

And even when intake is working, when requests are raised through a procurement platform like Spendflo - the job still isn’t done. The purchase isn’t complete until a PO exists in NetSuite.

In most teams, that last step is still manual, disconnected, and painfully slow. By the time finance sees the transaction, the money’s already gone. The subscription is already active. The vendor is already onboarded. You’re not managing spend - you’re just documenting it after the fact.

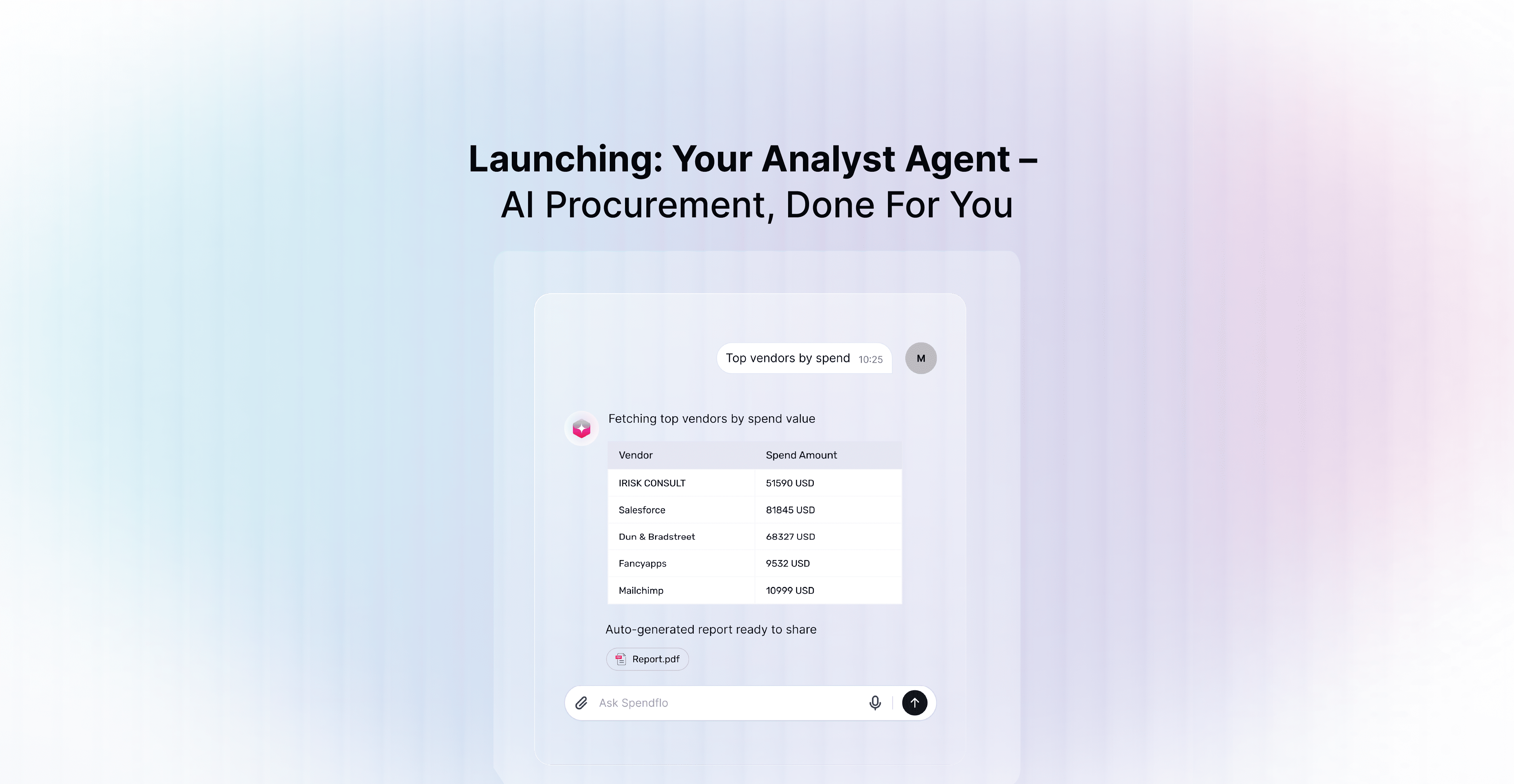

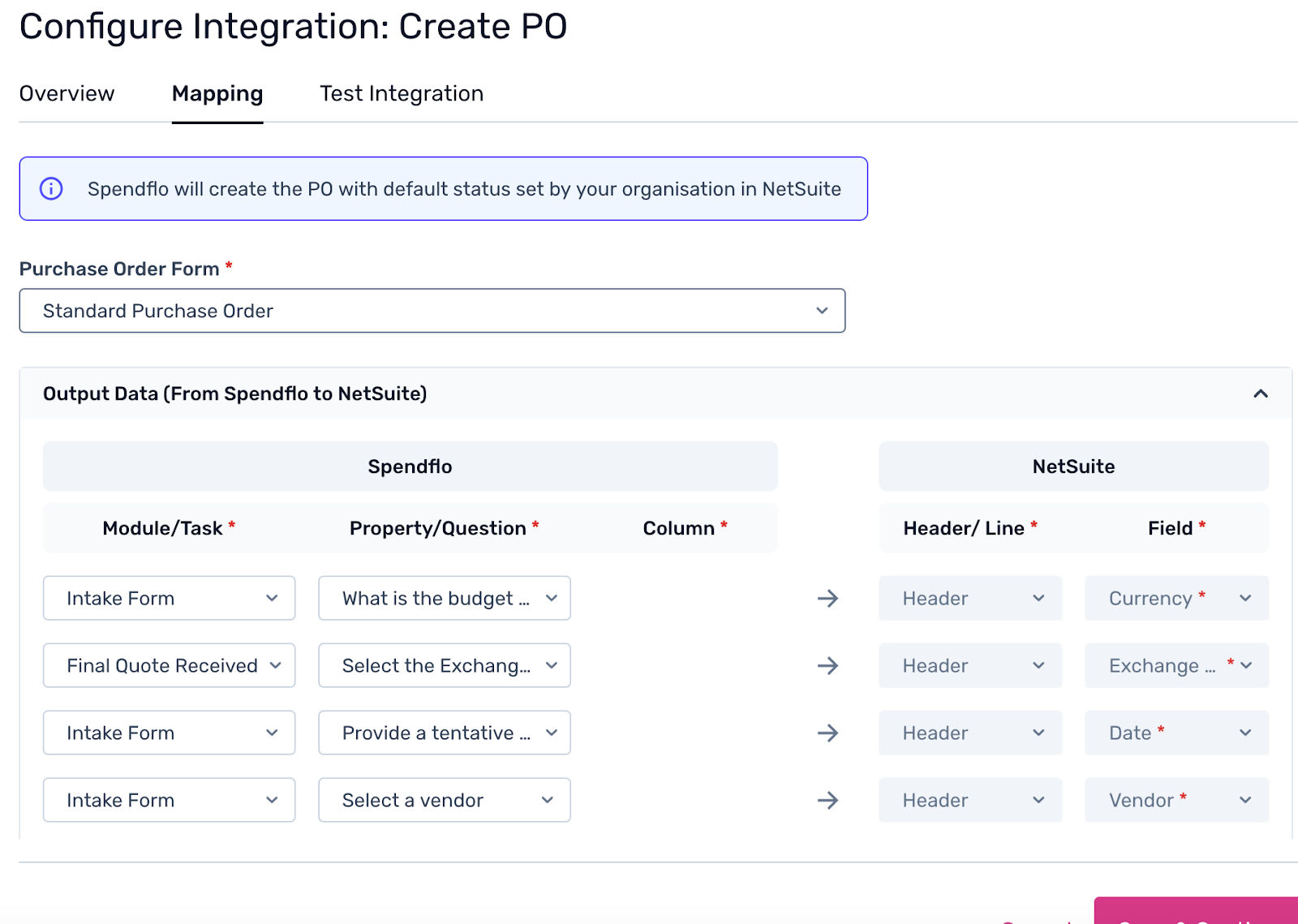

Spendflo x NetSuite: Intelligent PO Automation, Simplified Procurement

Spendflo and NetSuite close the gap between purchase requests and financial control.

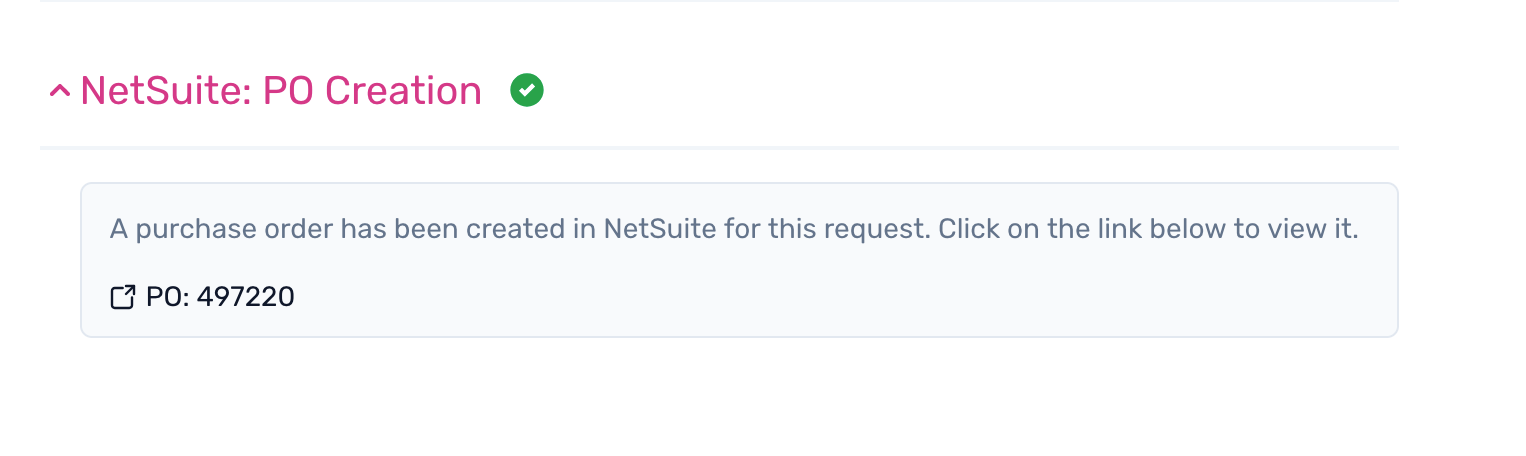

Once a request is approved in Spendflo, a purchase order is automatically created in NetSuite, eliminating manual handoffs, duplicate entry, and last-minute cleanup.

This means finance and procurement don’t just track spend after the fact. They govern it upfront. Every PO is created in NetSuite with the right approvals and context, vendor data stays consistent, and each transaction is fully traceable from request to invoice- without slowing teams down or compromising compliance.

With the Spendflo–NetSuite integration, teams can:

- Automate PO Creation – Generate POs in NetSuite instantly from Spendflo, reducing manual effort and errors. Once created, Spendflo fetches and displays the NetSuite PO ID and URL, giving finance teams a direct, auditable link for tracking and reconciliation.

- Ensure Accurate Financial Data – Pre-mapped vendors and fields ensure that every PO aligns with your NetSuite setup, maintaining consistency.

- Gain Complete Visibility – Track every PO from request to approval in Spendflo, ensuring full transparency at every step.

- Enforce Compliance – Admin-configured field mapping ensures mandatory information is always captured, reducing approval bottlenecks and audit risk.

The Business Impact

Better Financial Control

Every PO is created in NetSuite with the required fields and approvals in place, giving finance full visibility and a clean, auditable trail before spend occurs.

Faster Month-End Reconciliation

Real-time sync means fewer discrepancies. Organizations implementing automated PO creation see reconciliation time drop by up to 60%.

Increased Spend Under Management

By capturing all purchases at intake, companies typically increase spend under management by 40% on average.

Time & Cost Savings

Finance teams stop processing errors and start optimizing spend. Resources shift from administrative firefighting to strategic work.

"Finance teams shouldn't just be processing spend—they should be optimizing it. With the Spendflo x NetSuite ERP partnership, we’re making it easier to drive cost efficiency, enforce compliance, and make informed financial decisions.” — Sid Sridharan, CEO, Spendflo

How Intake-Based PO Automation Works

- Someone requests a purchase in your procurement platform

Could be a new SaaS tool, a renewal, or any company purchase.

- The system automatically creates a PO in NetSuite

Instant generation with pre-mapped vendors and fields. No manual work required.

- Finance sees and approves in real time

Full visibility before money leaves. Not after the fact.

- Everything's tracked from day one

Complete audit trail from request to payment. When the invoice arrives, it already matches a PO.

Ready to move from spend tracking to spend control?

Learn more about Spendflo's NetSuite integration or book a demo to see it in action.

.png)

.png)

.png)

.png)